Integrated Accounting

To achieve all the benefits of automation, software must match your business processes. Accounting has subtle differences across industries and no two businesses are alike. This is why Adaptive spends time understanding your business flows and customises our software to allow maximum benefit.

Our Chart of Accounts are tailored for each industry and our Finance offering includes the Journal, tailored Ledgers, Accounts Payable across all your suppliers and sub-contractors, Accounts Receivable, Trial Balance and Ageing Reports. There is also flexibility to create new ledgers, while income and expenses can be assigned to particular clients or suppliers.

For clients purchasing our Supply Chain, Client Order Management or E-Commerce Modules, each transaction will automatically update the General, AP and AR Ledgers, thus automating manual tasks and reducing fat-fingered errors. Purchase Orders are also integrated: Raise a purchase order, these are first approved as an internal control, track orders, handle change requests and benefit from shadowing invoicing and online payments.

Integrated Accounting

Have you outgrown your current accounting software? Is it inflexible?

Does it

integrate Client and Purchase Orders and the full life cycle of transactions?

Does it provide real-time reporting? Perhaps you still rely on excel.

Contact us to discuss your Digital Transformation.

Benefits of Integrated Accounting

| Benefit | Rationale |

|---|---|

| 1. Quick and Easy To Use: | When software is easy to use, user acceptance improves. Admin staff can sort ledgers alphabetically, while Finance staff can order by accounting standards. |

| 2. Customisable Chart of Accounts: | The Chart of Accounts are customisable. This provides for a flexible accounting solution. |

| 3. Assign Income & Expenses: | Track all your expenses from multiple suppliers/sub-contractors, in one place. If you are using multiple logins and instances, one per supplier, it is time to consolidate with one database to store all your data. Our system also lets you assign any income or expenses to particular Clients or Suppliers. This provides for more granular reporting. |

| 4. Accounts Payable (AP): | Expenses can be entered as Accounts Payable with each payment updating the AP Ledger. |

| 5. Accounts Receivable (AR): | The system lets you set records as Accounts Receivable to track expected income and monitor for arrears. |

| 6. Trial Balance: | The Trial Balance is fully automated with real-time data to help you identify discrepencies quickly. |

| 7. Ageing Reports (Income & Expenses): | The system provides separate ageing reports for income and expenses, to help you monitor upcoming income or expenses, as well as overdue payments. |

| 8. Fully Integrated with Adaptive ERP: | For those purchasing our Client Order Management, Bookings or E-Commerce modules, when Clients make payments

these are automatically entered into the relevant ledgers, thus automating data entry and

reducing the likelihood of fat fingered errors. If you include our Accounts Receivables module the AR records would also be updated

automatically.

For those purchasing our Supply Chain modules, when you pay Suppliers through the portal these transactions are also entered automatically into relevant ledgers and for Accounts Payables, the AP record would be updated automatically. |

| 9. Bank Reconciliation: | Automate bank reconciliation to ensure Ledgers match bank accounts. This assumes your bank is able to provide data in an accessible format. |

| 10. Multi-Year Operating Budgets: | Planning and budgeting are simplified with our automated operating budgets. Enter all relevant data, such as fixed and variable expenses, expected sales, depreciation and so forth and the system will calculate Actual vs. Expected Budgets, as well as Variance. Update as required and view Operating Budget Reports. |

| 11. Risk Register (Add-On): | Risk Registers form part of our Project Management software, but can be taken as a useful add-on in the Finance Function. Risks can only be managed when they are explained, quantified and monitored. |

Request a demo or consultation

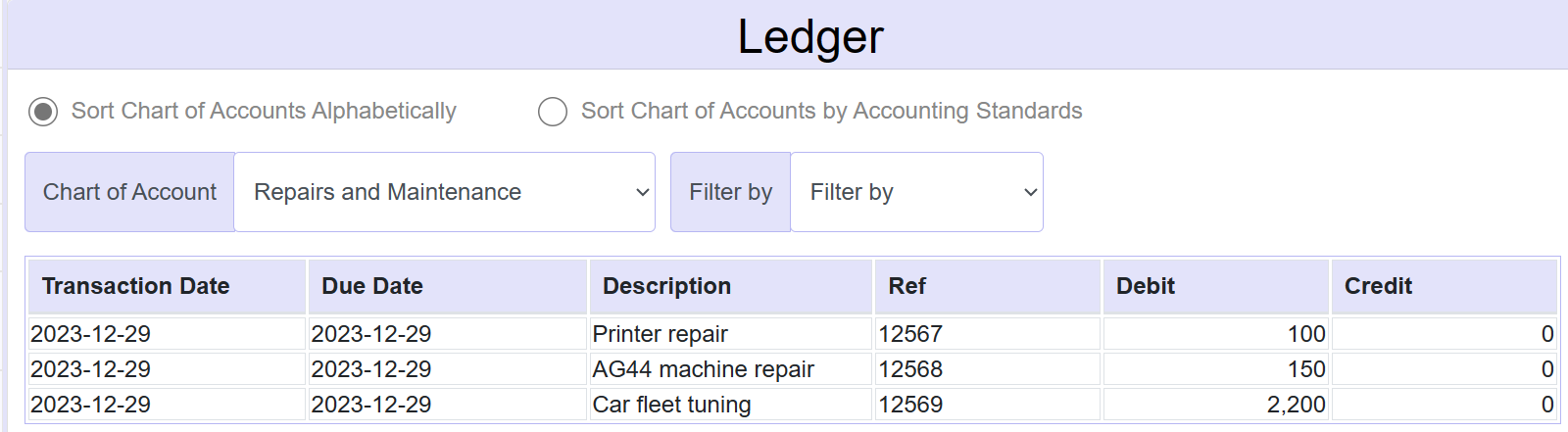

Ledger

- Overview: Filter by Chart of Account and month to view all debits and credits for the month

- Sorting: Chart of Accounts can be viewed alphabetically for support staff, or listed with codes and standard accounting order

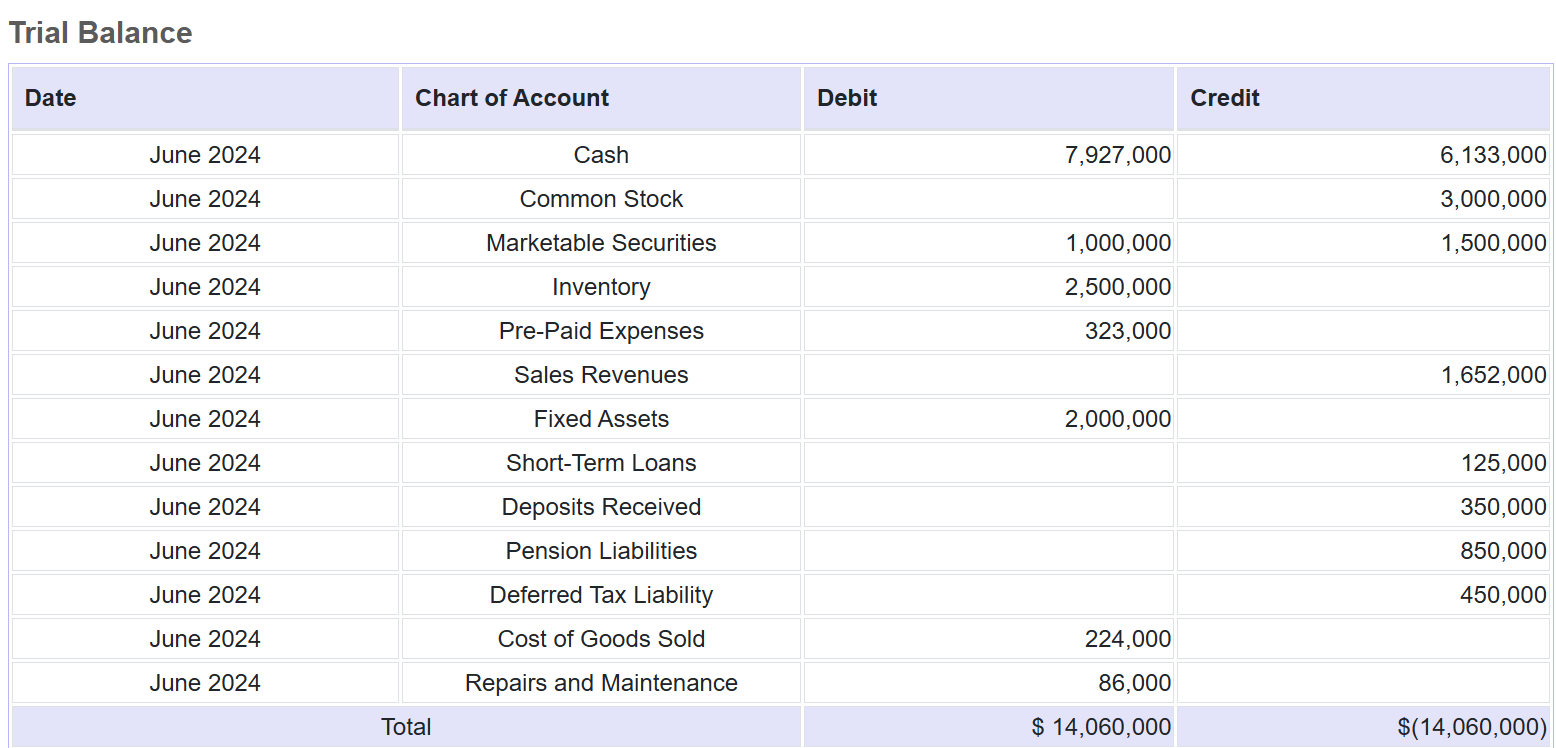

Trial Balance

- Overview: The Trial Balance shows total transactions across each Chart of Account where the sum of debits equals the sum of all credits. View all data or select a single month. When both sides do not balance, this serves to highlight journal errors

- Filters: To spot errors more quickly, filter on any single Chart of Account within the Trial Balance, to view a full list of transactions for a single journal

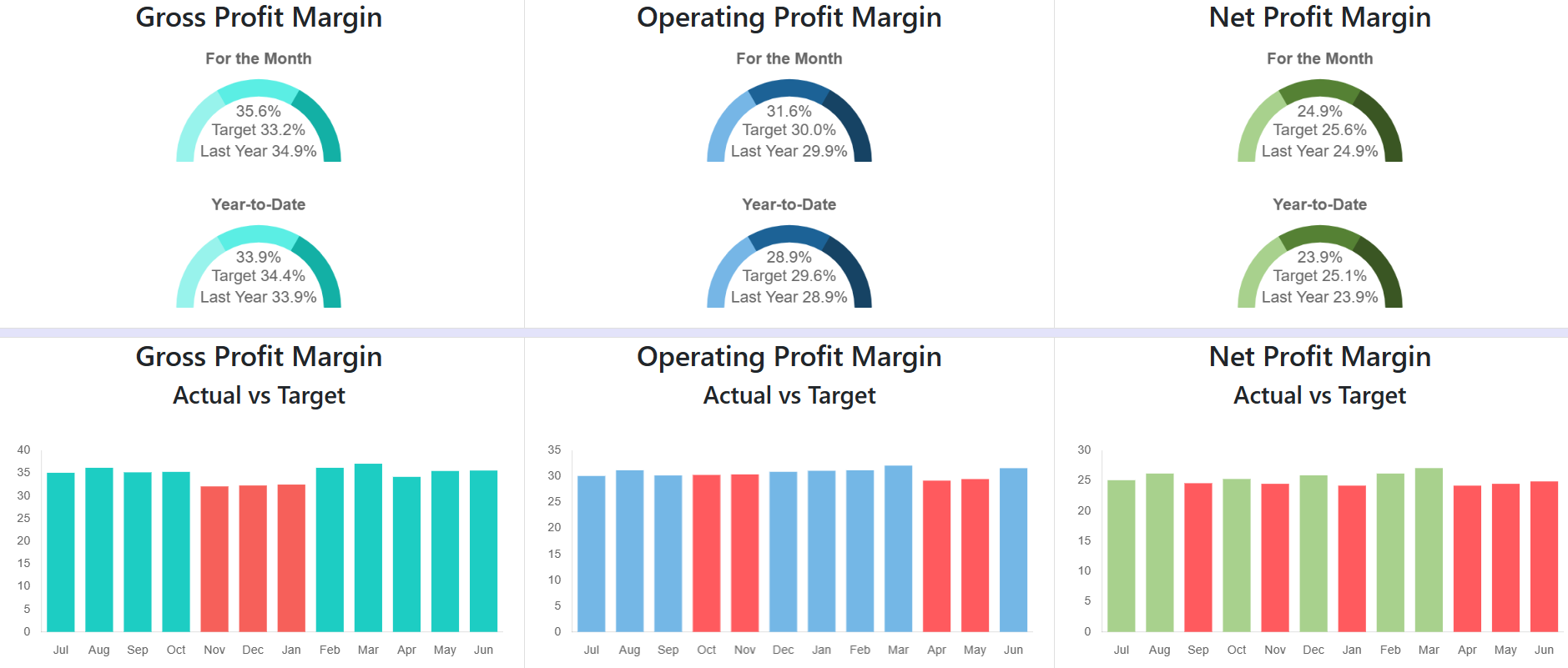

Margins

- Coverage: Margins refer to all inputs: Labour, Materials and Equipment. You can set targets and measure performance against targets. When input prices rise, if only some costs can be passed down the chain, margins may fall

- Margin Breakdown: View Gross Profit Margin, Operating Profit Margin and Net Profit Margin: Monthly and Year-To-Date

- Monthly Data: Also view monthly targets vs. actuals over the last year

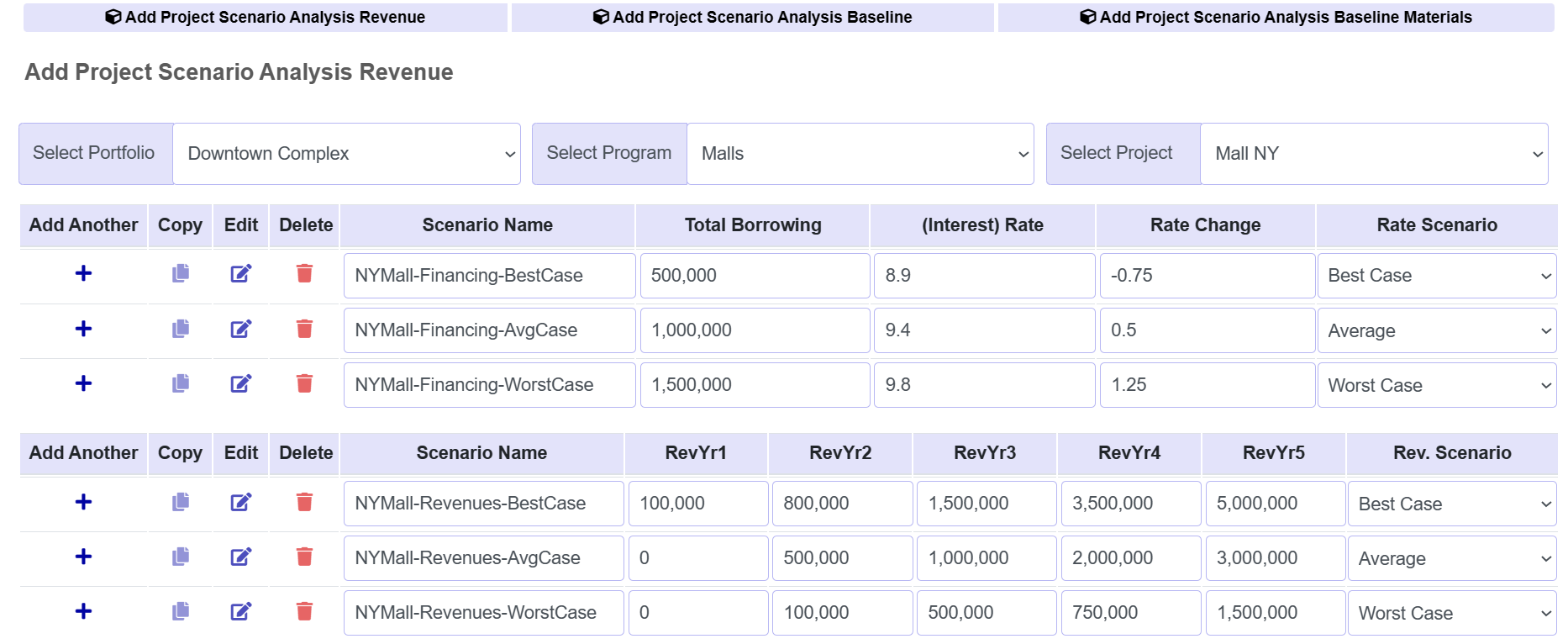

Scenario Analysis

- Financing & Revenues: Estimate total borrowing and financing costs, as well as estimated revenues out to 5yrs for best/average/worst case scenarios

- Labour & Materials: Estimate labour and material costs for best/average/worst case scenarios

- Select Scenario Name: Within Planning simply select a scenario name already created to pre-populate this scenario and expected ROI

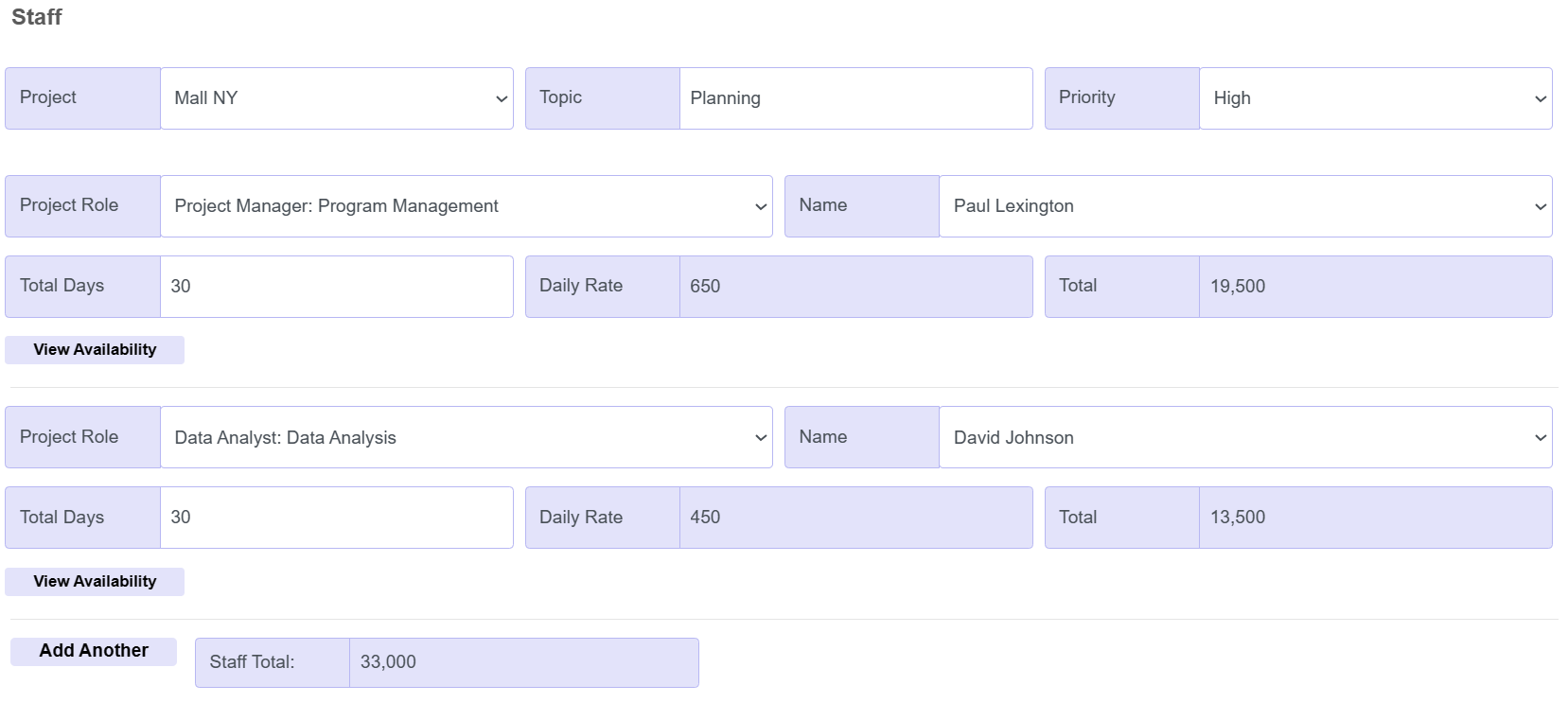

Labour Cost Budgeting

- Create Budgets with Ease: During Planning to estimate staffing costs: First select project, then task/high level topic and priority

- Select Staff: First select role, which filters to show only internal staff, contractors and suppliers listed for this role. Then select person and estimate number of days

- System-Based Pricing: System-based pricing is used to calculate total labour cost for internal staff, contractors and suppliers

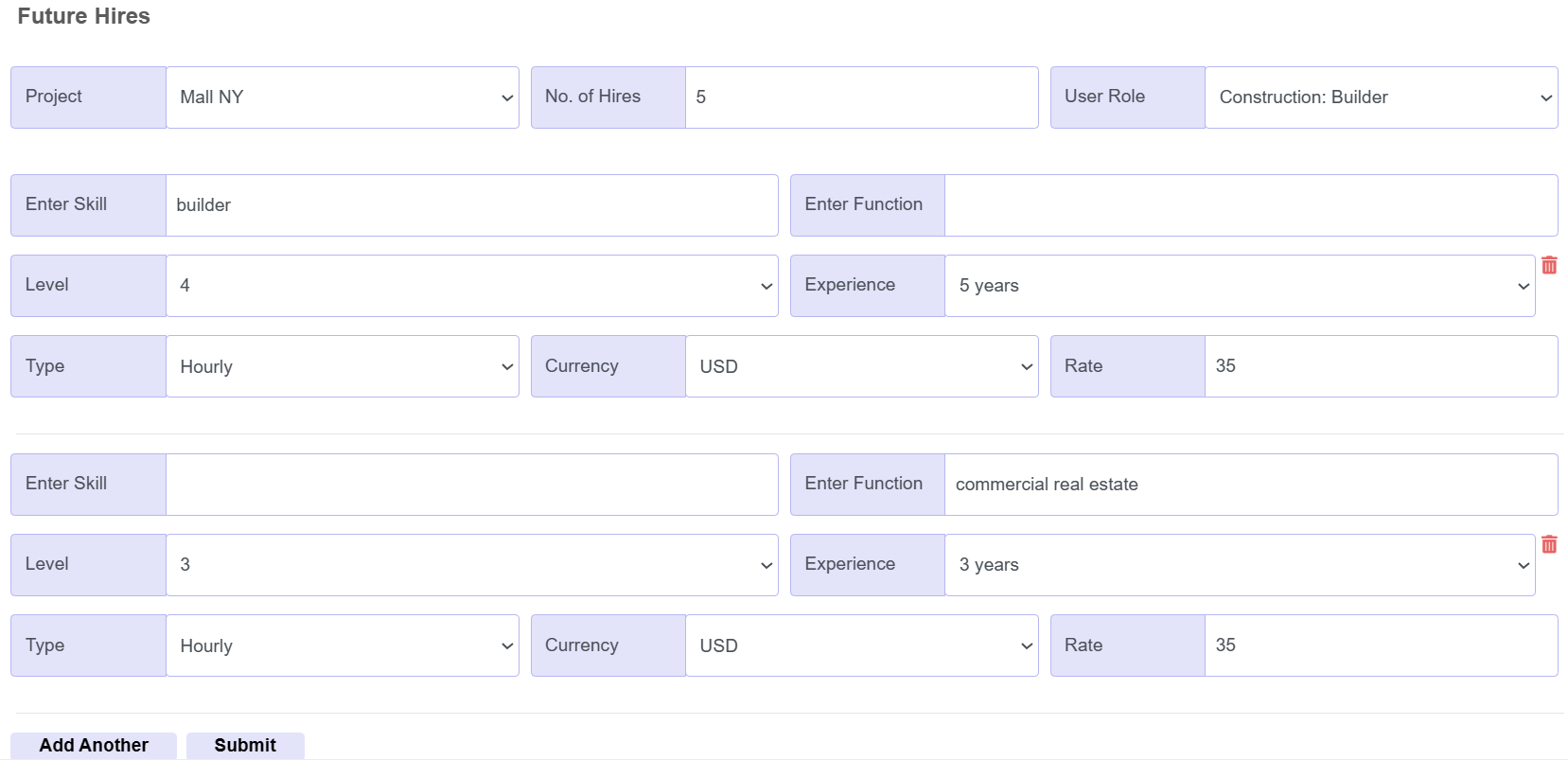

Future Hire Budgeting

- Future Hires: Enter role, skills, functions/sector, experience, level, expected days, estimated labour rates and number of people, to estimate the costs of future hires

- New Hires: These are unknowns so actual data is not yet held in the system

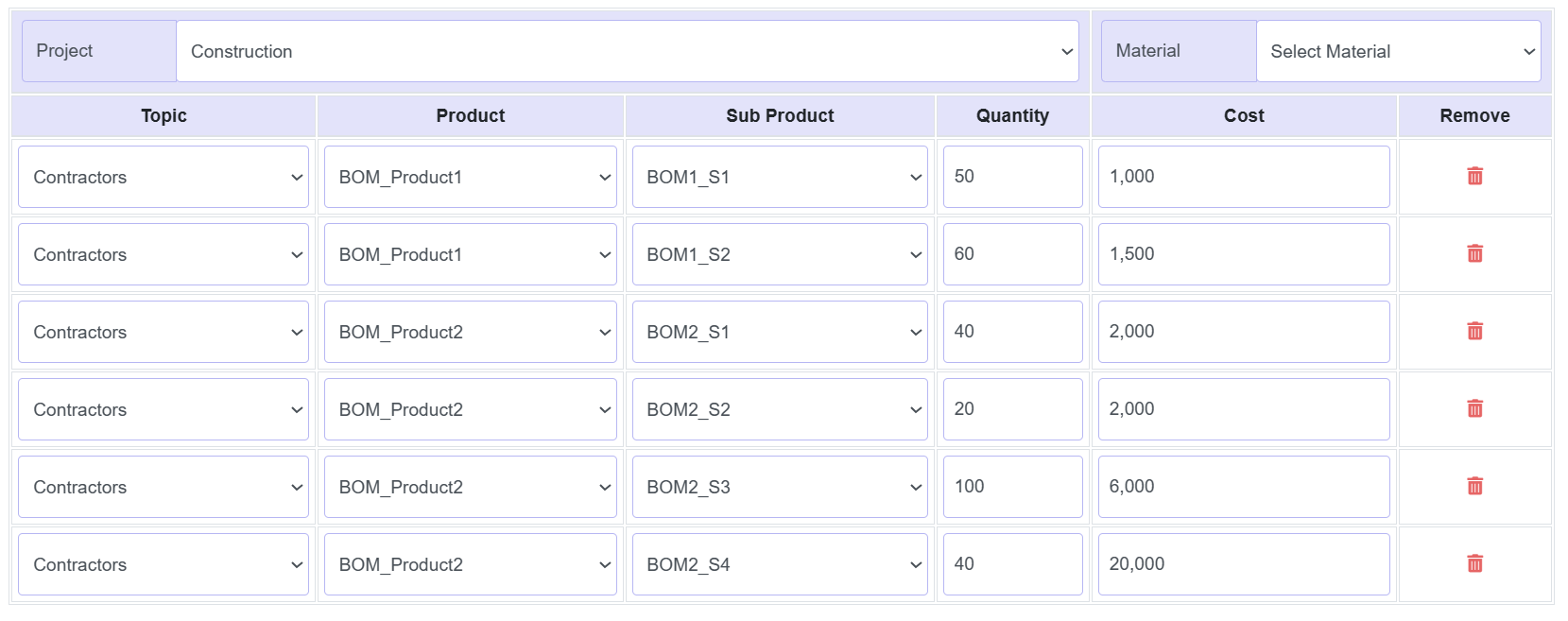

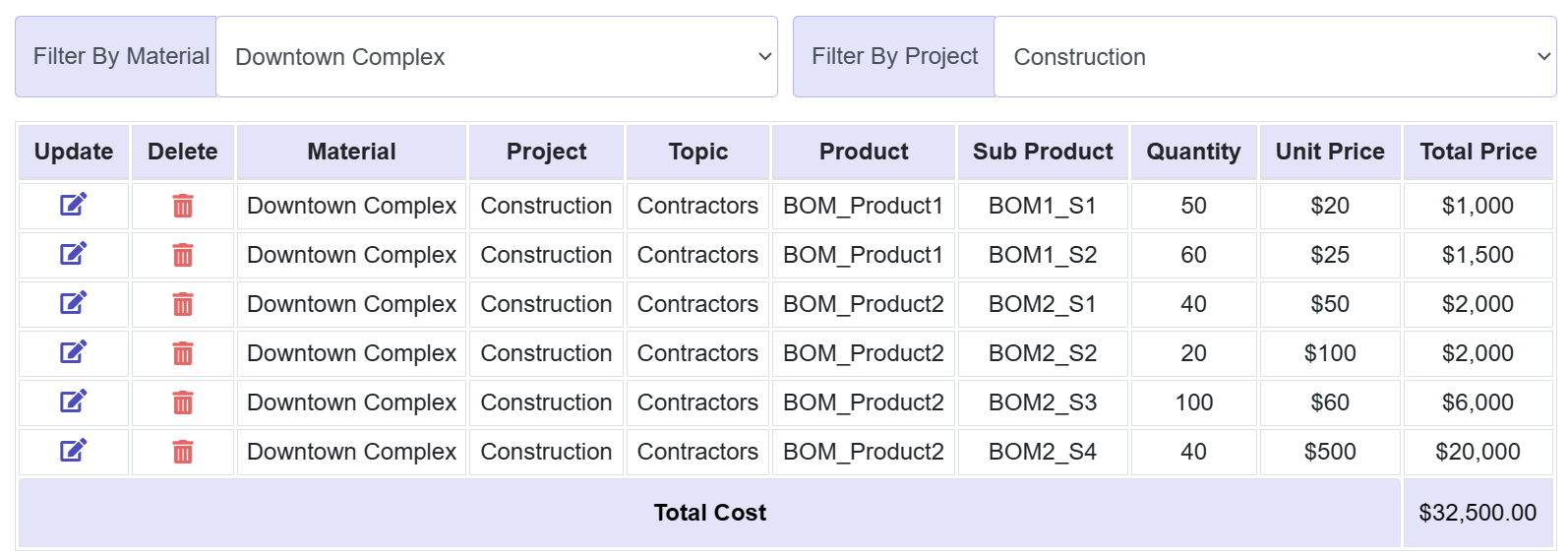

Material Budgeting

- Select Materials: For projects requiring materials (e.g. construction), select products and product sub-types, from registered suppliers

- System-Based Pre-Approved Pricing: System-based pre-approved pricing is used to calculate expected cost. Approvals are required before suppliers can update pricing. The system also generates a "shadow invoice" against which to validate the supplier's actual invoice to mitigate supplier fraud risk

Material Report

- View: Per task, there is a Material Name that groups all materials for this task. Filter by Project and Material Name to view a full list of materials

- Edit/Delete: Update or delete this data as needed

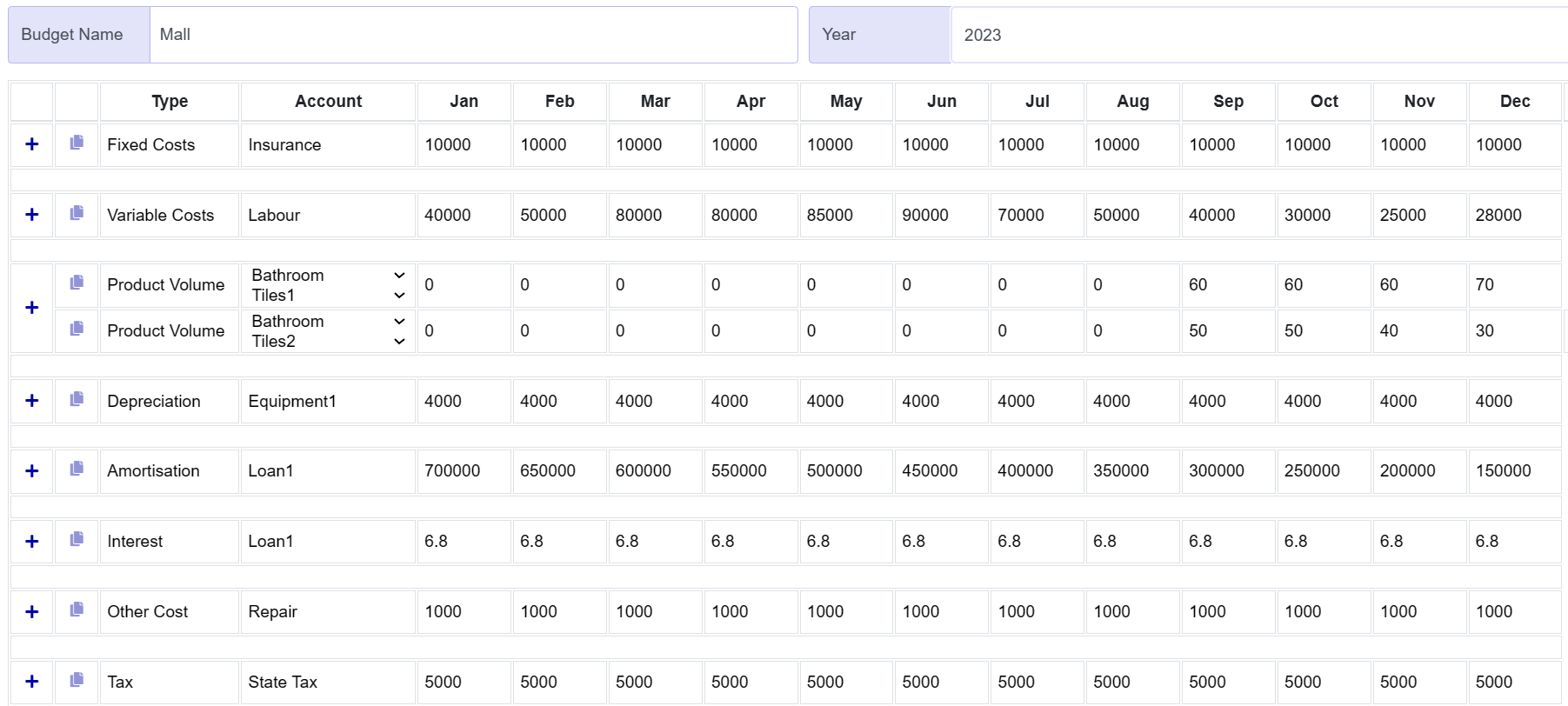

Multi-Year Operating Budgets

- Multi-Year Operating Budgets: Our multi-year operating budget module lets you estimate fixed and variable costs, depreciation, amortisation, interest, other expenses, tax and sales volumes

- Rapid Data Entry: Add Another and Copy Buttons let you create a new row, copy a previous row and adjust quickly, or enter a value once and copy it, to pre-fill the entire row with the same value

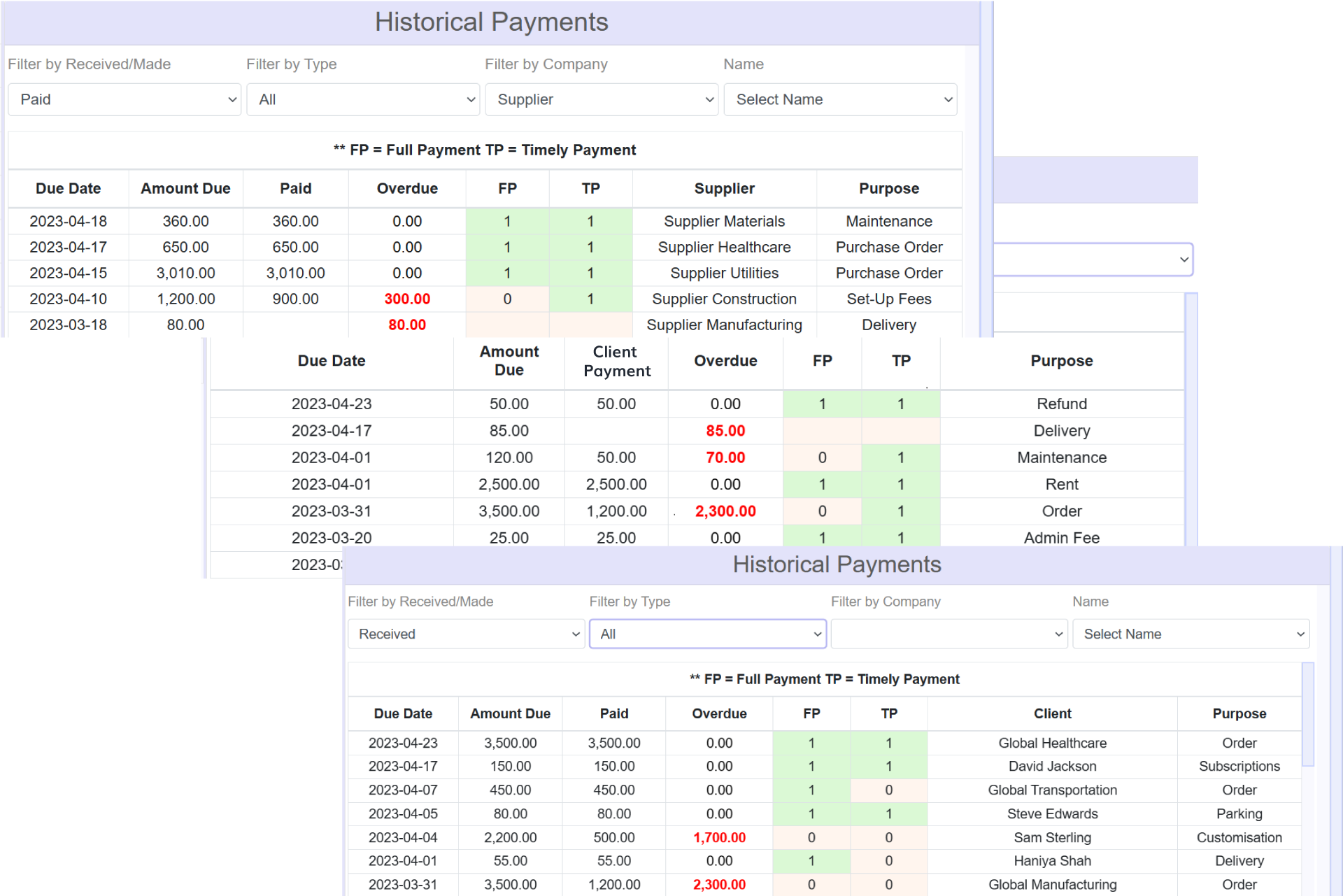

Historical Payment Reports

- Granular Data: Sellers are provided with granular payment data. Filter by payments received from clients, or paid to suppliers. There are separate filters to view refunds to clients and from suppliers. You can also filter by overdue, as well as no payments made

- Credit History: To gain greater insights into a client's credit history, the system shows if each payment was made in full and on time. You can view all data or filter by client or supplier

- Client-Side Reporting: Clients also see their own payment reports in their dashboards, allowing them to monitor all transactions. This is an invaluable tool for management, finance and support and should reduce many payment-related queries sent to support