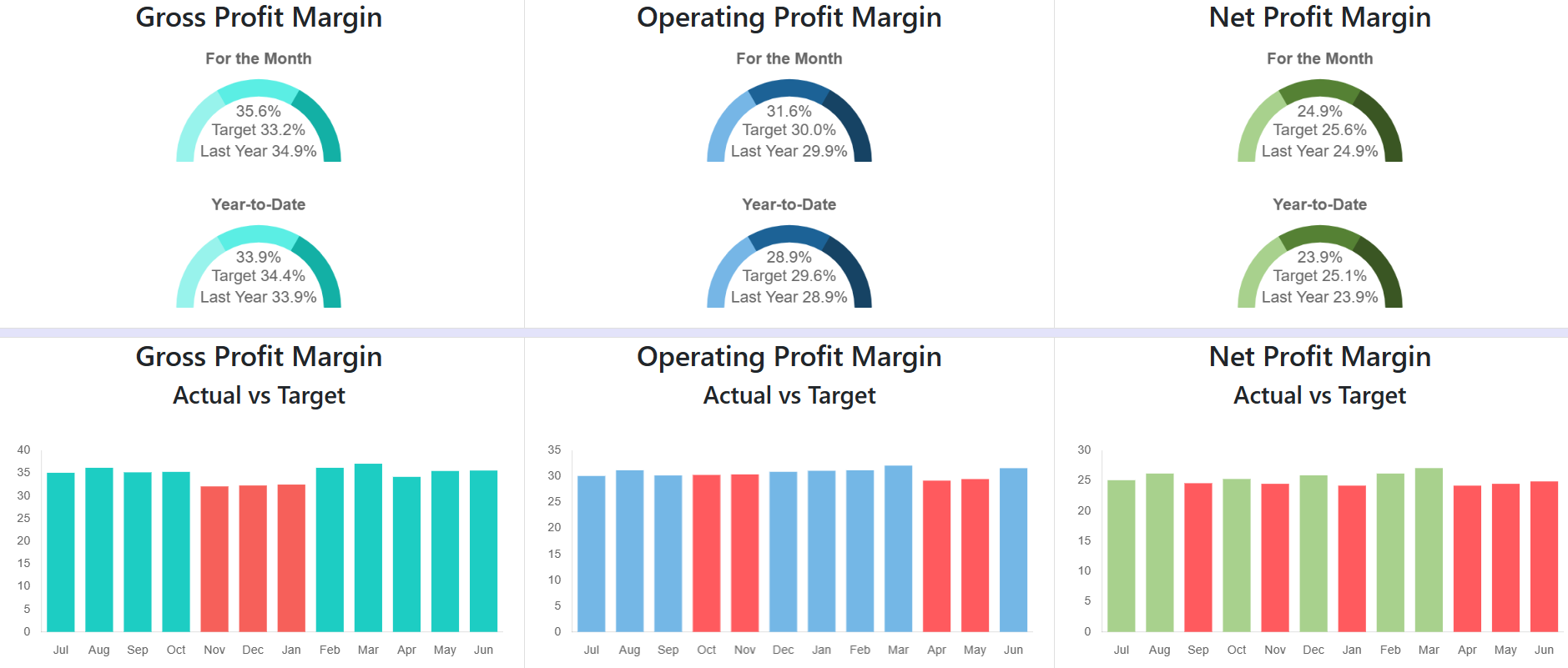

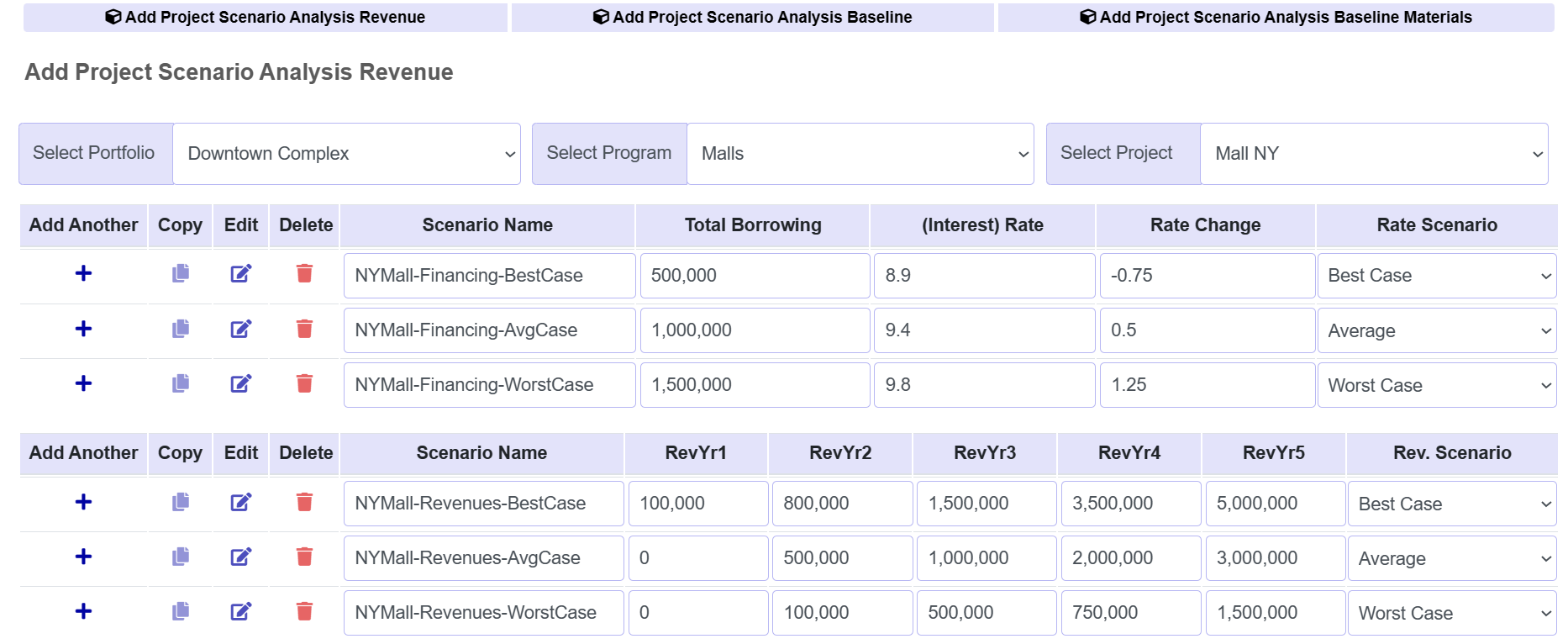

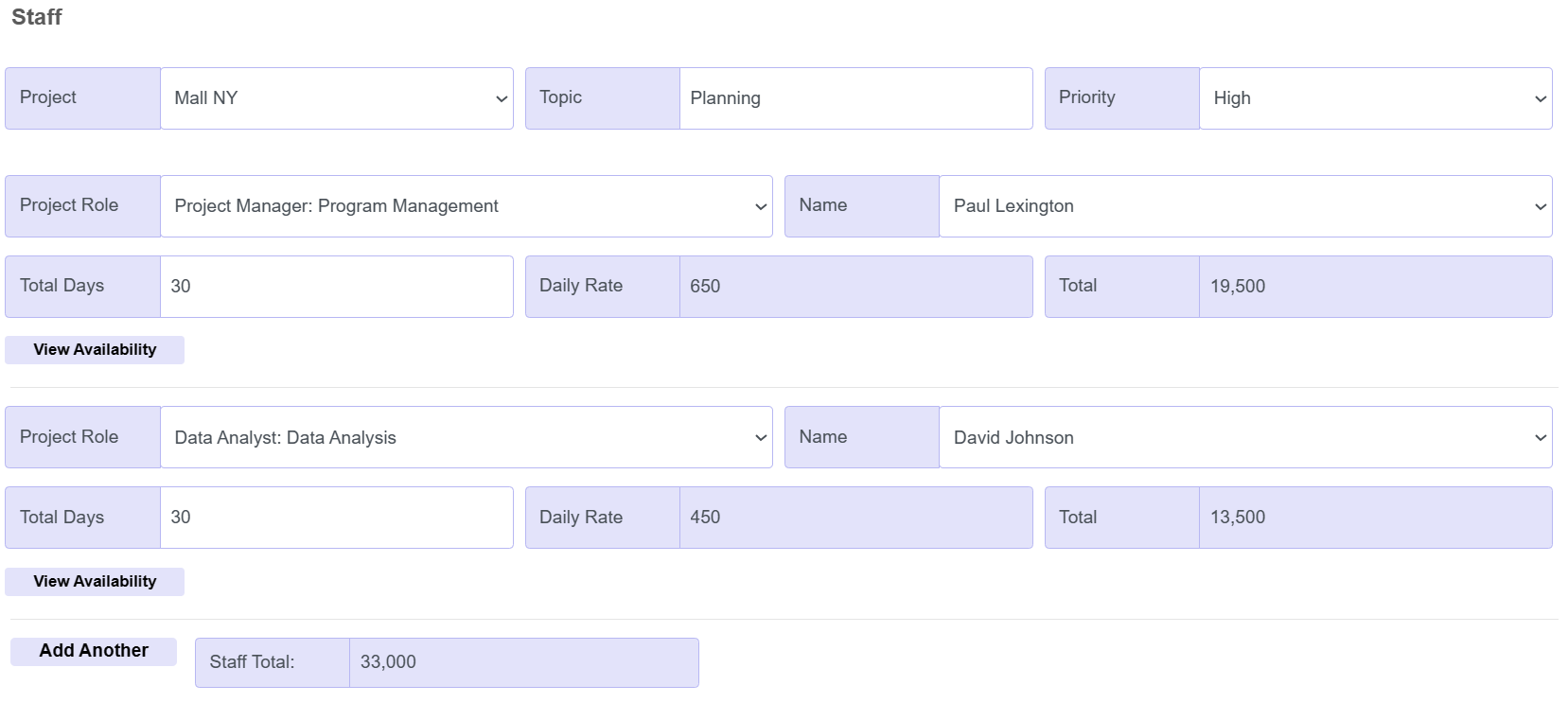

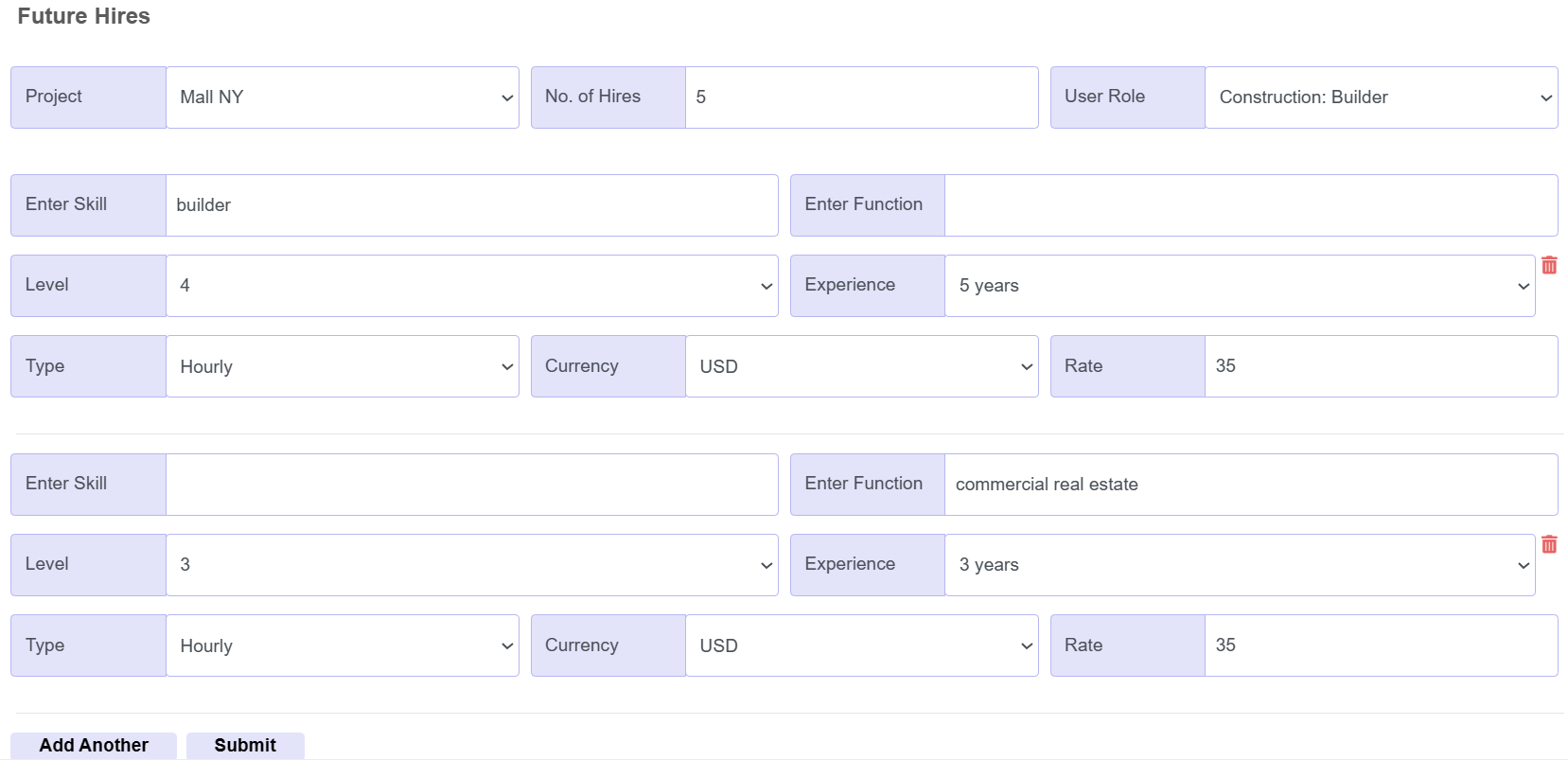

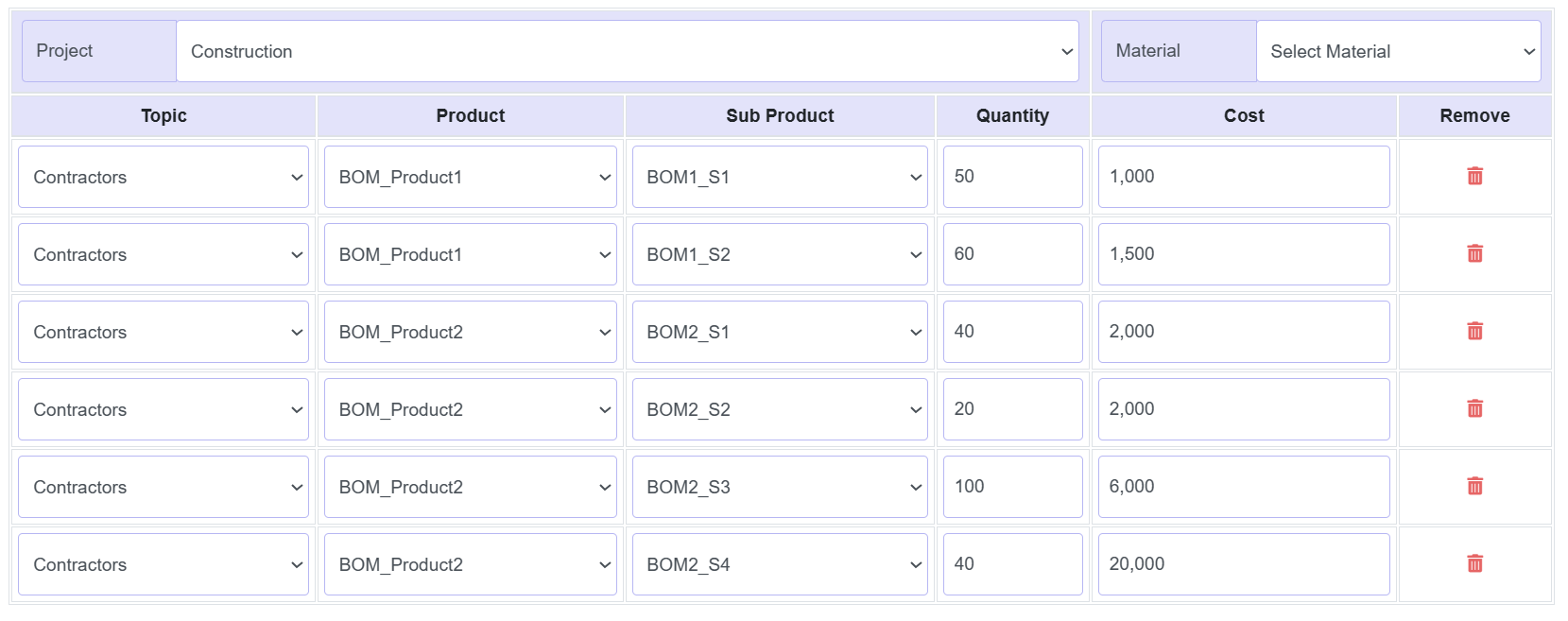

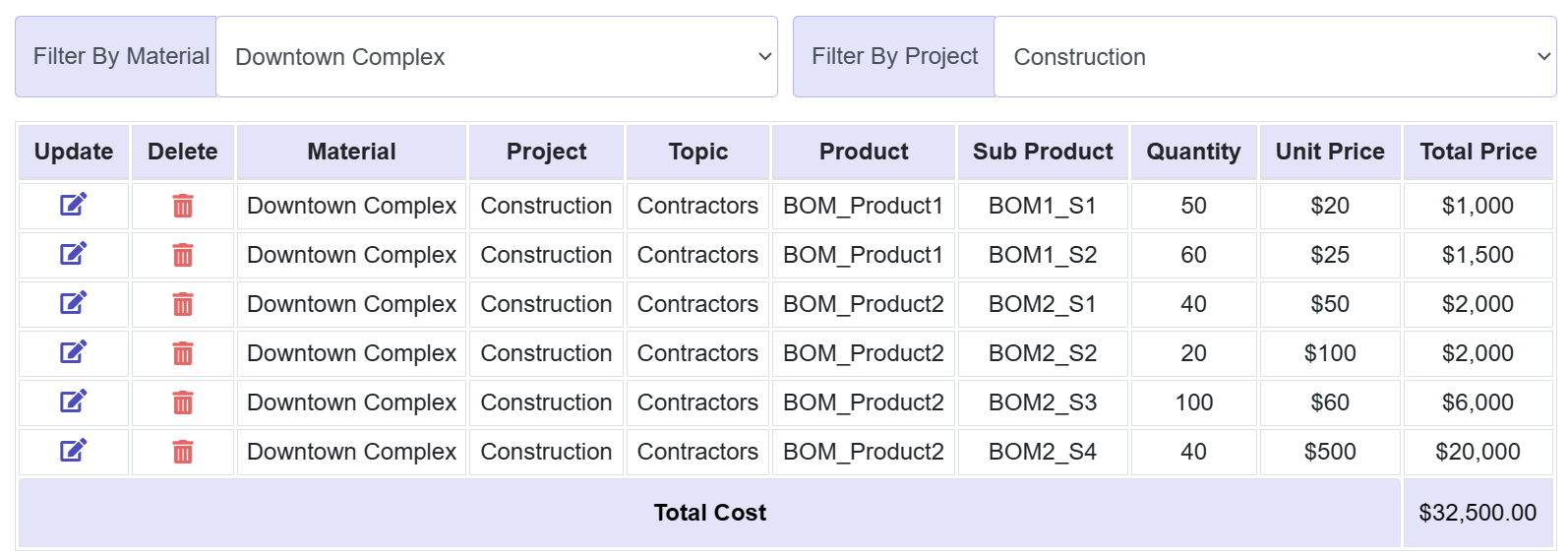

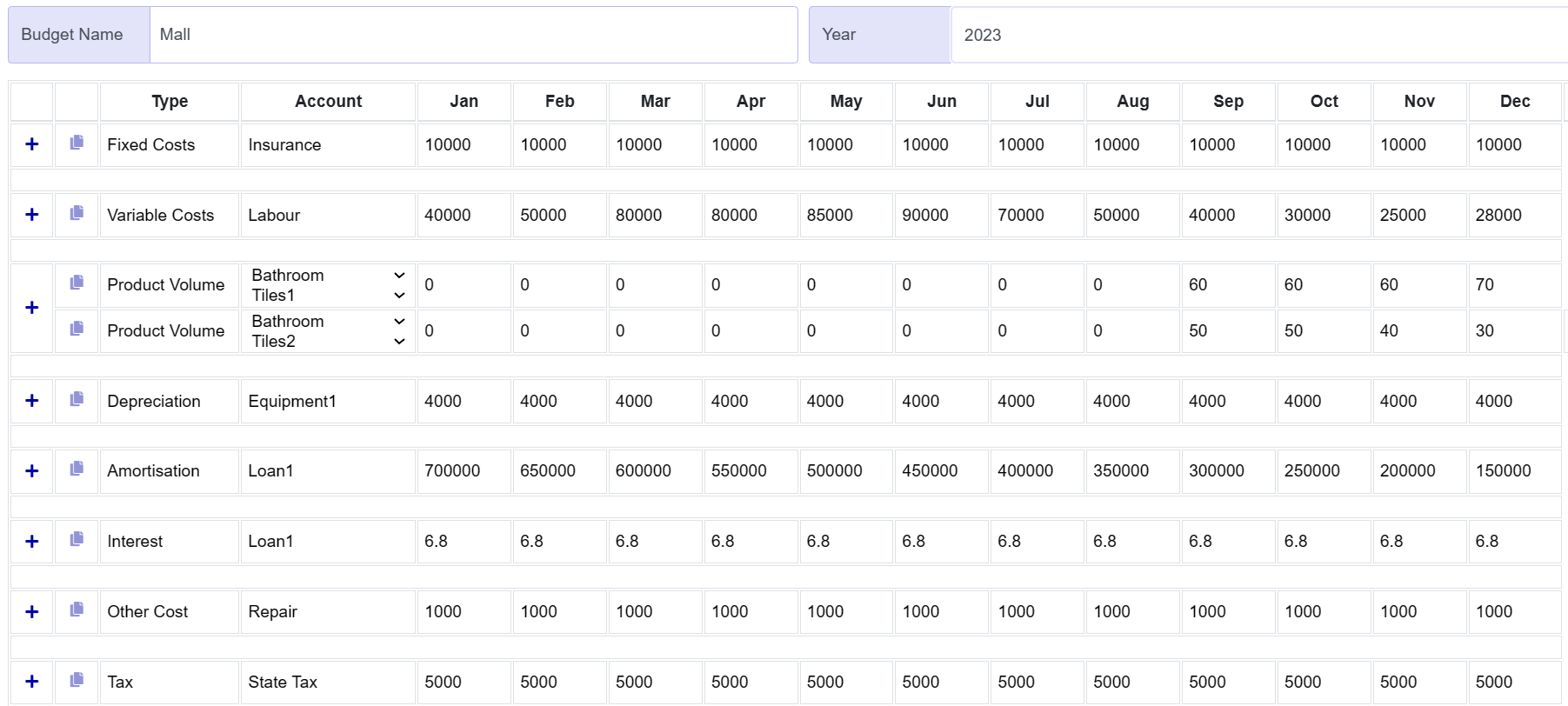

Run scenario analysis to plan and budget labour, materials and borrowing. Create multi-year operating budgets. View gross, net and operating profit margins.

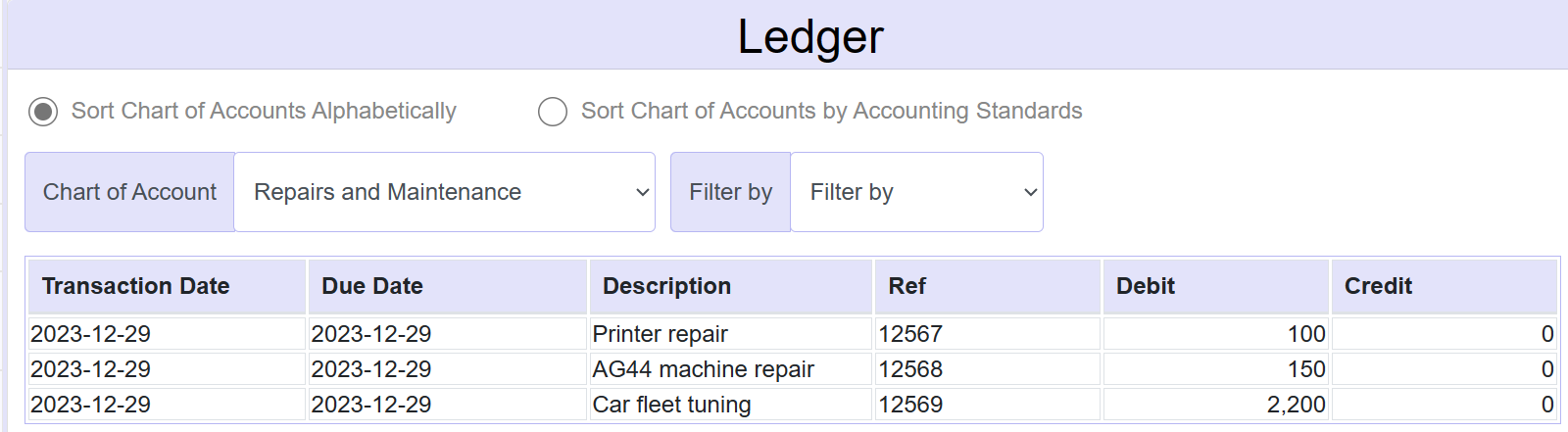

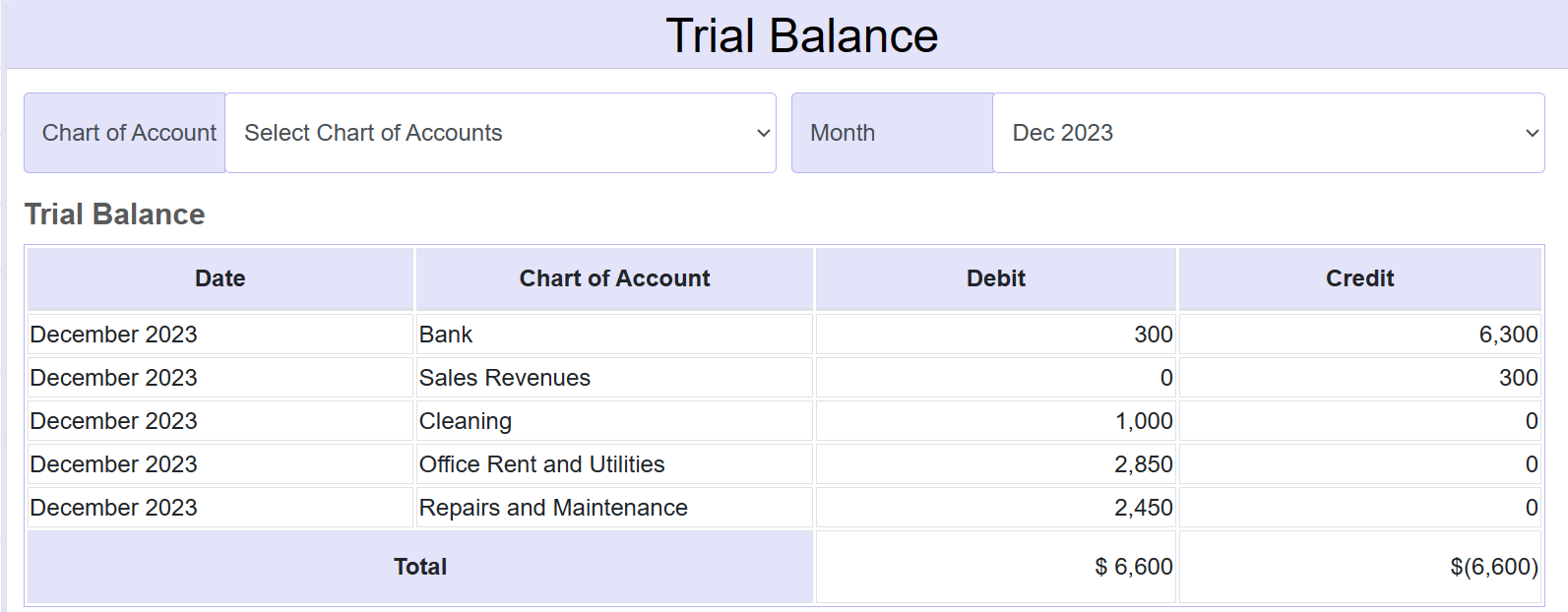

Benefit from quarterly and annual Financial Statements (Balance Sheet, Profit & Loss, Cash Flow), customisable Chart of Accounts, Journal, General Ledgers, AP, AR, Trial Balance and Ageing Reports.

Clients can view and pay invoices securely within their portal. We also create "shadow invoicing" for purchase orders to counter multiple risks.

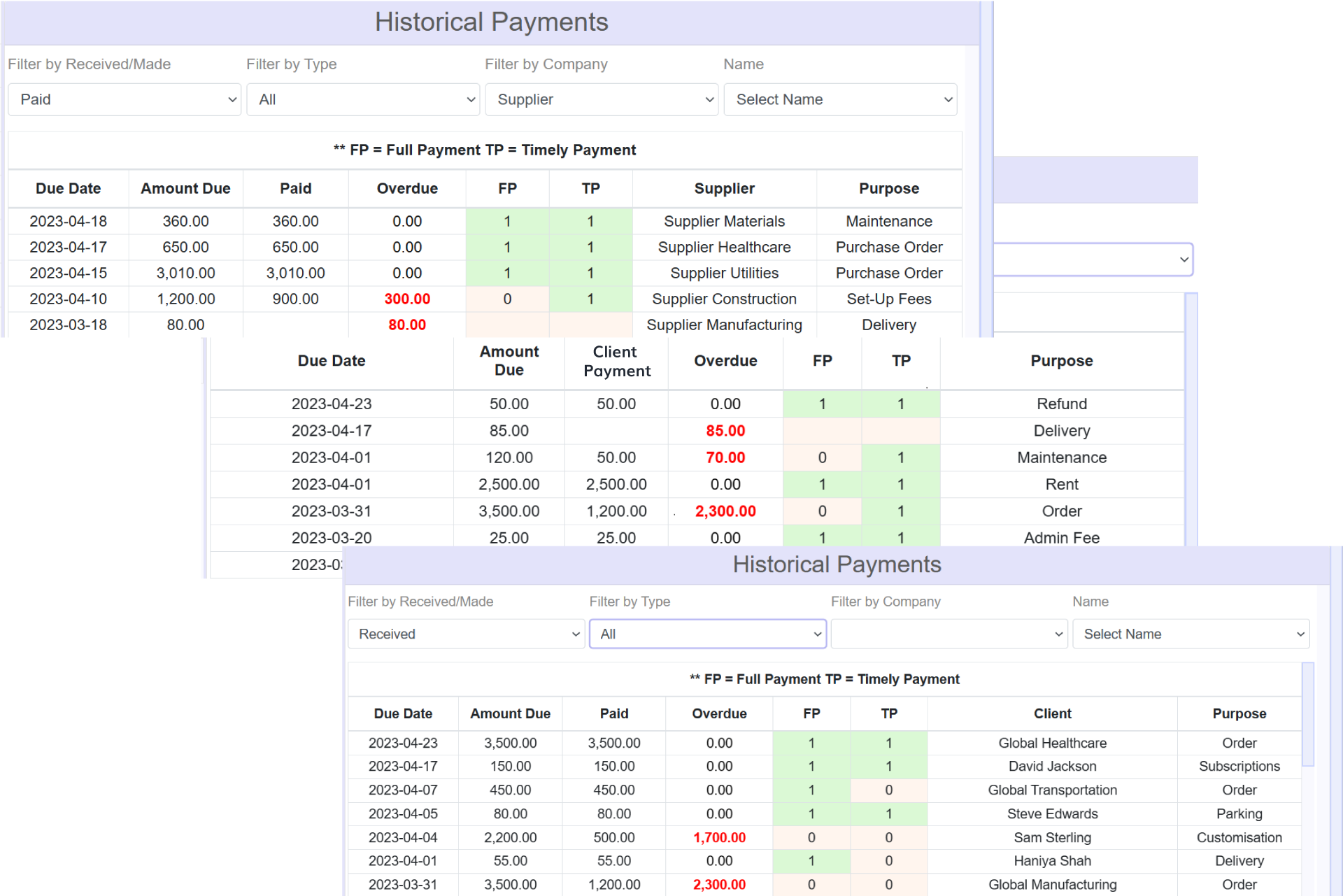

View details of each payment to suppliers plus income from clients. Reports also show whether each transaction was paid in full and on time.